Politics

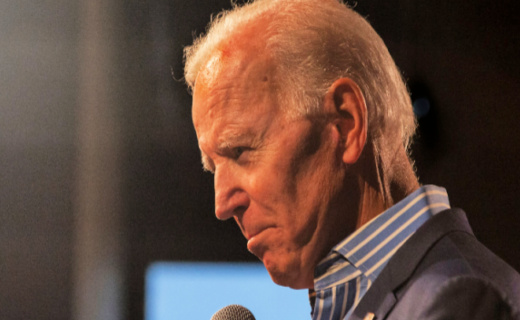

Under Biden administration, Fed makes biggest benchmark interest rate hike since 1994

The Federal Reserve launched its biggest campaign against inflation to date on June 15th, raising benchmark interest rates by three-quarters of a percentage point in a move that amounts to the most aggressive increase since 1994.

Putting an end to weeks of speculation, the Federal Open Market Committee tasked with setting rates raised the level of its benchmark funds rate to a range of 1.5% to 1.75%, the highest since just before the start of the Covid pandemic.

Stocks were volatile after the decision but rose when Fed Chairman Powell spoke at his post-meeting press conference.

“Clearly, today’s 75 basis point increase is an unusually large one, and I do not expect moves of this size to be common,” Powell said.

However, he added that he expects the July meeting to witness a 50 or 75 basis point increase. He said that decisions will be taken “meeting by meeting” and that the Fed “will continue to communicate as clearly as possible our intentions.

Officials also significantly reduced their economic growth outlook for 2022, now forecasting only a 1.7% gain in GDP, down from 2.8% in March.

The projection for inflation as measured by personal consumption expenditures also rose to 5.2% this year from 4.3%, although core inflation, which excludes rapidly rising food and energy costs, is shown at 4.3%, up just 0.2% from the previous projection. Core PCE inflation came in at 4.9% in April, so June 15th’s projection calls for an easing of price pressures in the months ahead.

The estimates as expressed in the committee’s summary of economic projections predict a sharp decline in inflation in 2023 to 2.6% for the stock and 2.7% for the core, with expectations little changed from March.

Longer term, the committee’s policy outlook is largely consistent with market projections of a series of future hikes that would bring the funds rate to about 3.8%, its highest level since late 2007.

The statement was endorsed by all FOMC members except Kansas City Fed President Esther George, who preferred a smaller increase of half a point.

First-quarter growth declined at an annualized rate of 1.5%, and an updated estimate from the Atlanta Fed, via its GDPNow tracking tool, put the second quarter as flat. Two consecutive quarters of negative growth is a widely used rule of thumb to demarcate a recession.

For weeks, policymakers have insisted that half-point – or 50 basis points – increases could help stop inflation. In recent days, however, CNBC and other media outlets have reported that conditions are in place for the Fed to go beyond that.

A recent series of troubling signals has prompted the most aggressive action.

Inflation for May as measured by the Consumer Price Index increased at an annual rate of 8.6%.

The job market has been a bright spot for the economy, even though May’s gain of 390,000 was the lowest since April 2021.

The committee’s projections released on June 15th have the unemployment rate, currently at 3.6%, climbing to 4.1% by 2024.

This story syndicated with permission from Frank at TrendingViews.com