Politics

BIDEN’S AMERICA: Social Security Crisis Could Devastate 70 Million Retirees

According to a new government report, a staggering 70 million retirees could see their Social Security benefits slashed within just nine years unless Congress steps in. This isn’t a hypothetical scenario—this is a stark reality that could leave millions of Americans in financial turmoil.

The latest Social Security Trustees report reveals that the Old-Age and Survivors Insurance (OASI) trust fund is projected to run dry by 2033. If Congress does nothing, there will only be enough incoming cash from taxes to cover about 79% of the benefits. This means around 70 million people would see their benefit checks shrink significantly.

(Protect your money NOW with this free guide)

What is causing this shortfall? For decades, Social Security had a surplus, fueled by strong population growth and economic expansion. This surplus was invested in special U.S. Treasury bonds. But now, as baby boomers retire and life expectancies rise, the total benefits paid out have skyrocketed. Meanwhile, lower birth rates mean fewer workers are paying into the system. Since 2018, the program has paid out more in retirement benefits than it has received in taxes.

In 2022, the SSA withdrew $70.4 billion from the OASI trust fund to cover retirement benefits, leaving $2.64 trillion at the end of the year. But as more people start collecting benefits and the workforce growth can’t keep up, this drawdown rate will accelerate. By 2033, the trust fund will be empty, and incoming taxes will only cover a fraction of the benefits.

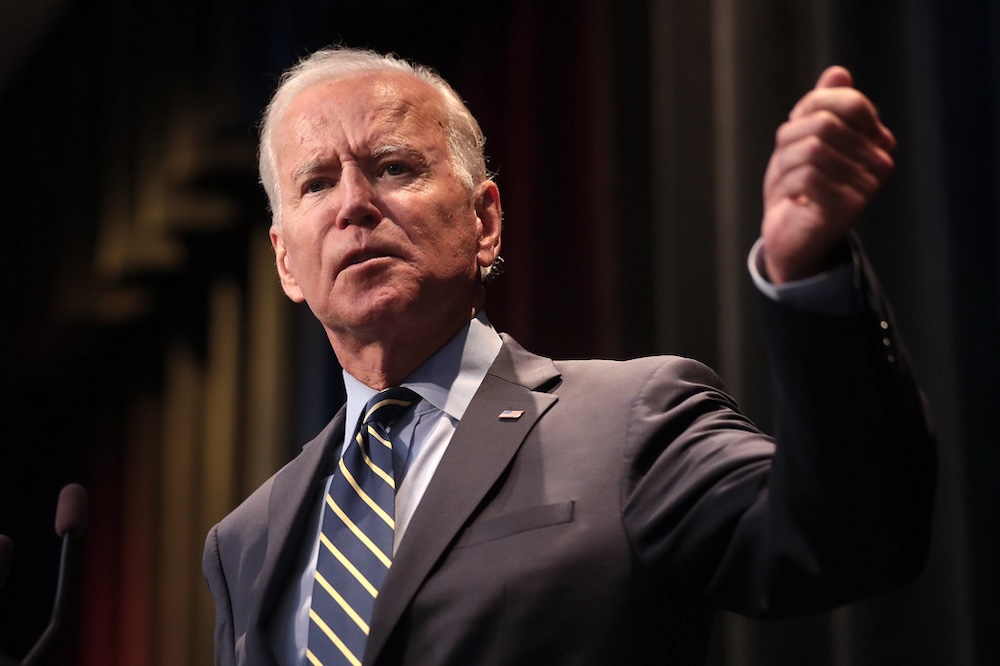

With Joe Biden at the helm, no realistic solutions will be implemented, which could leave 70 million retirees in the dark. Many are calling this “typical” of Biden’s America.

The looming collapse of Social Security is a wake-up call for all retirees. With 70 million retirees facing potential benefit cuts in just nine years, it’s time to take proactive steps to protect your financial future. The harsh reality is that Social Security cannot be relied upon. The system is on the brink of depletion, and Congress’s inaction only accelerates the crisis.

So, what can you do? Do the best you can to safeguard your wealth now. One of the best hedges against rising costs and a crumbling Social Security system is investing in precious metals. Gold and silver have stood the test of time as reliable stores of value, protecting against inflation and economic instability.

Download this FREE guide to protect your self from Biden’s economy

Unlike paper currency, precious metals are tangible assets that hold intrinsic value. When the dollar falls and Social Security benefits are slashed, those with investments in gold and silver will find a safety net amidst the chaos. Don’t wait for Congress to act—take control of your financial security today.

Many experts have advised retirees to invest in precious metals to ensure their retirement is shielded from the economic uncertainties ahead. Prepare now, stay informed, and protect your hard-earned money from a system that’s proving increasingly unreliable.

SPONSORSHIP DISCLAIMER:

This offer is made available through a sponsorship arrangement. The free gift is provided is not associated with any purchase requirements. Our sponsor is a distinct entity, and not affiliated with any of our products or services. By claiming the free guide offered on the next page, you acknowledge and consent that your information will be shared with our sponsor, who may contact you via phone, SMS, or email.

Our sponsor and its representatives are not licensed or registered as investment advisors, attorneys, CPAs, or any other form of financial service professional. They do not provide legal, tax, accounting, or investment advice. The content provided on this site, including all statements and claims, are the opinions of our sponsor and should not be considered as professional or financial advice.

Investing in precious metals involves risks, including the potential loss of principal. The value of precious metals can fluctuate significantly and is not guaranteed. Past performance is not indicative of future results. It is important that you conduct your own due diligence and consult with your own financial, legal, and tax advisors before making any investment decisions.

By participating in this offer, you agree to be bound by our Terms of Service and Privacy Policy and the disclaimer outlined above. Please review these documents carefully before proceeding.

Claim your free guide at your own risk and discretion