Politics

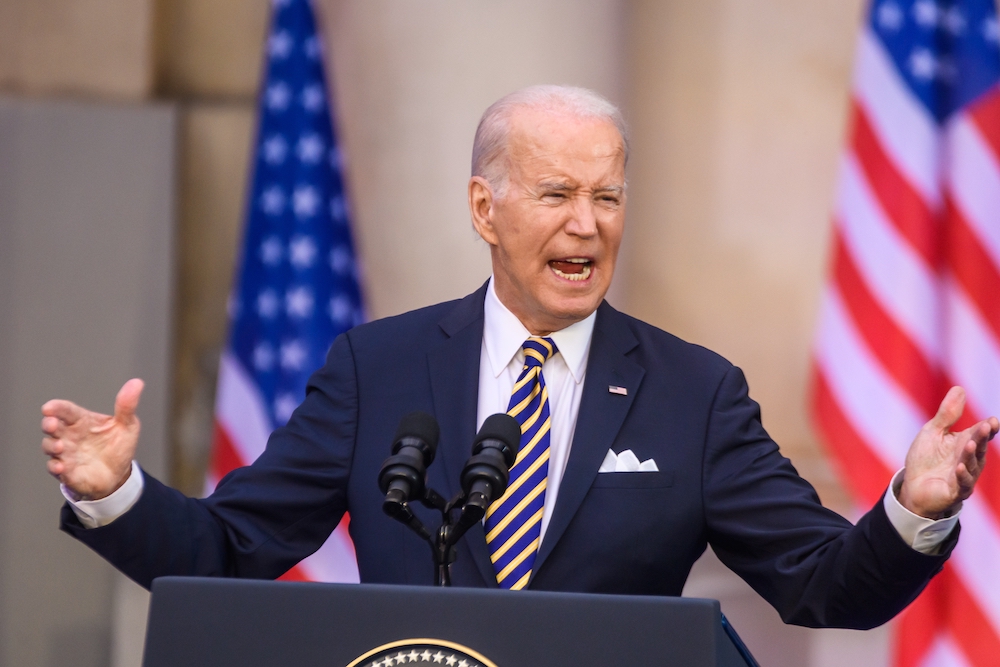

NEW: Appeals Court Smacks Down Joe Biden’s Student Loan Scheme

A controversial student loan repayment plan is now in jeopardy as legal challenges mount. Known as the Saving on a Valuable Education (SAVE) plan, the initiative from the Biden administration has aimed to make college loans manageable for millions of Americans. However, the plan has gotten significant opposition, culminating in two lawsuits led by Republican states.

On Wednesday the Biden administration approached the Supreme Court, seeking permission to continue reducing monthly payments for about three million borrowers enrolled in SAVE. The request came at a critical time, as the program’s future hangs in the balance with ongoing legal reviews in lower courts.

On Thursday, a federal appeals court issued a temporary block on the plan, a decision that could significantly impact millions of borrowers according to Forbes.

Unveiled last year, the SAVE plan is an income-driven repayment program that promises affordable payments and several options for loan forgiveness. However, opposition has argued that the Biden administration has overstepped the authority granted by Congress. Earlier this month, three GOP-led states pushed for the Supreme Court to keep a partial block on the program while their legal challenge is addressed.

The main concern is that such unilateral action to implement sweeping loan forgiveness and adjustments in repayment terms circumvents the legislative process, setting a precedent that could affect future governance.

Proponents argue that forgiving or reducing student loans on such a large scale may lead to increased federal deficits and potentially higher taxes to compensate for the shortfall. There is a belief that it might disincentivize educational institutions from keeping tuition costs in check, knowing that the federal government might step in to ease the burden on students.

Last month, the Biden administration’s student loan relief efforts hit a roadblock when federal courts in Kansas and Missouri delivered conflicting rulings on the SAVE plan. In Kansas, a federal judge issued a preliminary injunction halting reduced payments under SAVE, which were slated to begin in July. The plan aimed to cut undergraduate borrowers’ payments by up to 50 percent. However, the judge allowed other facets of the SAVE initiative to proceed, including provisions for student loan forgiveness after 10 to 25 years, based on the borrower’s degree program and the total amount borrowed.

In Missouri, another federal court took a contrasting stance by blocking the student loan forgiveness component of the SAVE plan. Despite this, the Missouri court permitted the Education Department to move forward with implementing reduced payments under SAVE, as scheduled for this month.

Missouri escalated its legal challenge against the SAVE plan by appealing to the 8th Circuit Court of Appeals, seeking to overturn a partial injunction that only blocked student loan forgiveness under the plan. On Thursday, the 8th Circuit responded with an order that appeared to halt the entire SAVE plan.

“Appellants’ emergency motion for an administrative stay prohibiting the appellees from implementing or acting pursuant to the Final Rule until this Court rules on the appellants’ motion for an injunction pending appeal is granted,” the order wrote.

The Court of Appeals’ order could potentially freeze the entire SAVE plan, impacting not only lower payments but also extensive subsidies designed to curb runaway interest accrual and automatic income recertification according to Forbes. This is the same court that previously halted Biden’s initial attempt at student debt cancellation.

(YOURS FREE: Trump 2024 “Still Standing” Flag With Iconic New Imagery)