Politics

JUST IN: House Reveals Details On Trump’s ‘Big, Beautiful’ Bill: ‘American Workers First’

House Republicans have released the full details of President Trump’s highly anticipated tax and economic reform legislation: “The One, Big, Beautiful Bill.” The proposal, spearheaded by House Ways and Means Committee Chairman Jason Smith (R-MO), builds on the foundation laid by the 2017 Tax Cuts and Jobs Act (TCJA) and aims to secure permanent tax relief for American workers, boost wages, and reestablish U.S. economic dominance through pro-growth, pro-America reforms.

The bill is divided into three key focus areas: protecting American workers, supercharging the U.S. economy, and holding elites accountable. From repealing taxes on tips to eliminating corporate handouts in Biden’s Inflation Act, the package takes a blunt and unapologetic stance in favor of American workers and families.

At the heart of the legislation is a series of worker-centered tax reforms. The bill eliminates income taxes on tips, providing relief for the 4 million tipped workers in restaurants, hospitality, and service industries. It also removes income taxes on overtime pay, benefiting more than 80 million hourly workers.

For families, the bill allows full deductibility of auto loan interest for American-made vehicles, a significant financial break for working-class households. Middle- and low-income seniors will see an additional $4,000 deduction, providing relief to retirees amid continued inflationary pressures.

The bill locks in President Trump’s 2017 tax reforms, making the doubled standard deduction and lower tax rates permanent. According to the House Committee on Ways and Means, failure to extend these provisions would lead to a $1,700 tax hike on the average working family.

The legislation also increases the Child Tax Credit by $500, raising the total to $2,500 per child and helping families offset the cost of Biden-era inflation. Data from the Council of Economic Advisers (CEA) projects the bill will increase annual real wages by $2,100 to $3,300 per worker and boost take-home pay for median households by $4,000 to $5,000.

The bill’s proponents say the legislation is the only thing standing between the American economy and a massive employment crisis. The National Association of Manufacturers warned that up to 6 million jobs, including 1.1 million manufacturing jobs, would be lost if the TCJA is allowed to expire.

The legislation’s supporters cite industry-by-industry projections to support their claims. If passed, the bill is expected to save 719,000 jobs in retail, 658,000 in food services, 634,000 in healthcare, 584,000 in science and tech, and hundreds of thousands more across construction, waste services, and financial sectors.

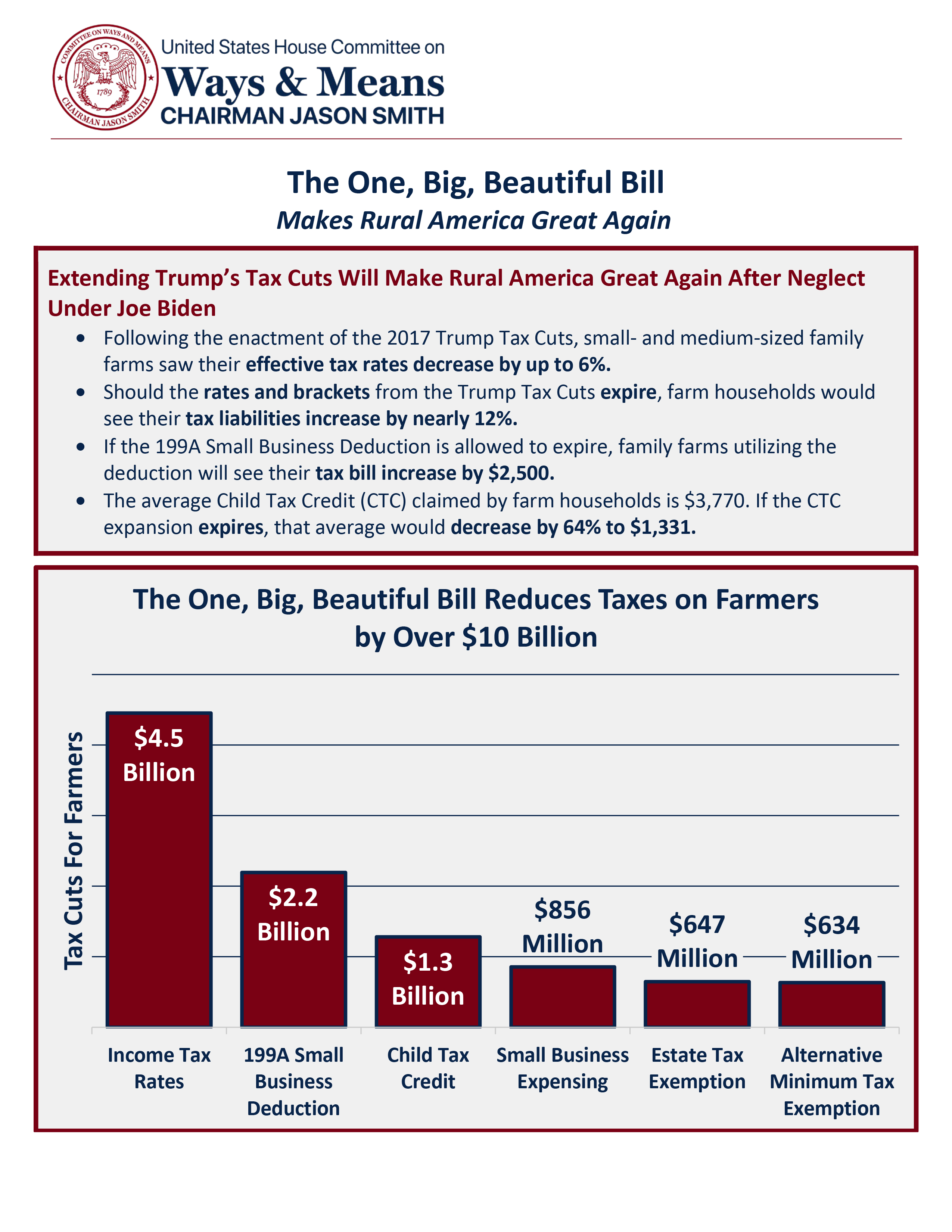

Beyond tax relief, the bill contains powerful incentives to spark investment and GDP growth. It restores 100% immediate expensing for business investment, revives full expensing for research and development, and makes permanent the 23% Small Business Deduction. According to CEA modeling, these provisions alone would boost investment by 4.2 to 6.6 percent and raise long-run real GDP by up to 1.5 percent.

The legislation also expands Opportunity Zones, a signature initiative of the 2017 TCJA, with the goal of bringing $100 billion in private capital into distressed communities. Early data shows that Opportunity Zones nearly doubled new housing construction in low-income areas and increased employment by up to 4.5 percentage points compared to similar non-OZ communities.

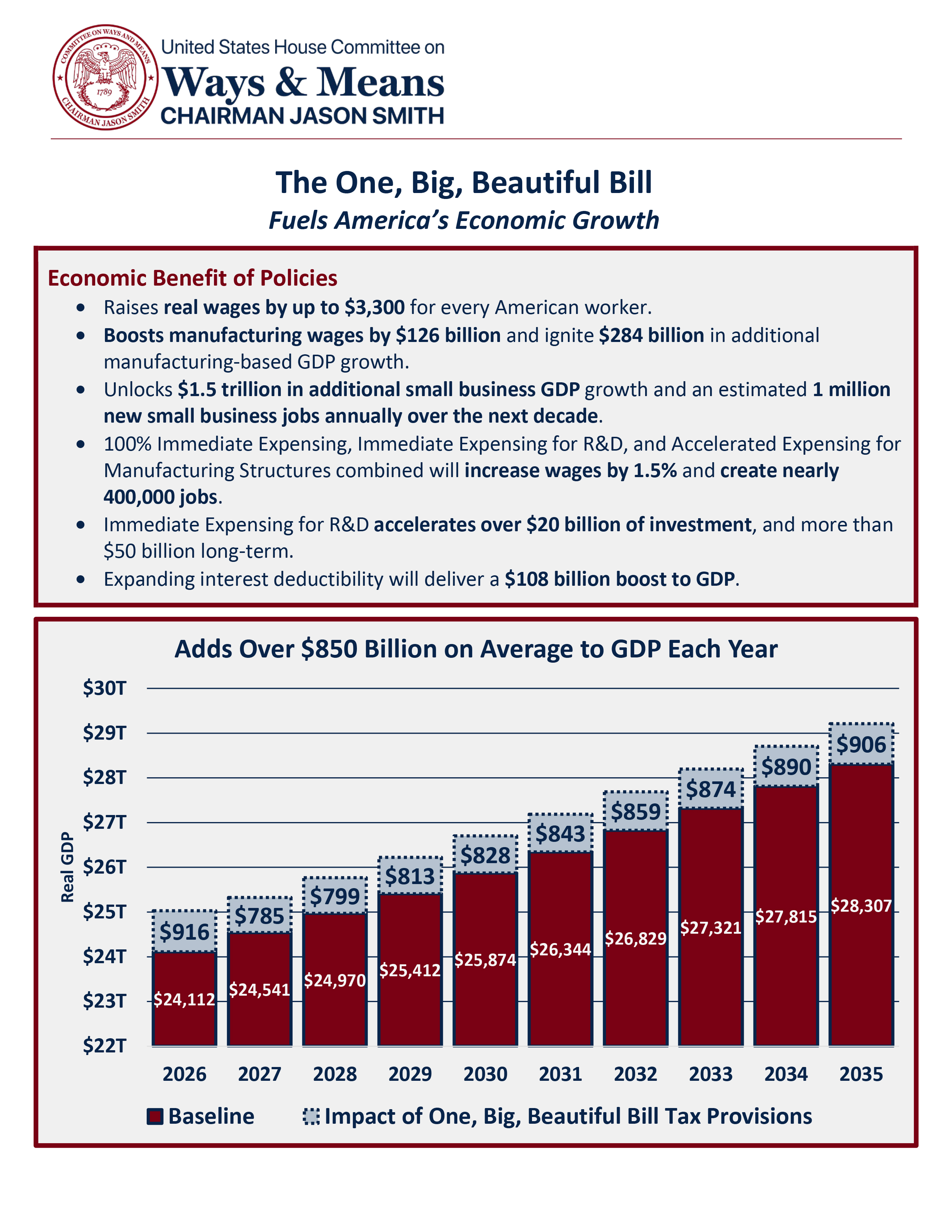

A chart included by the House Committee estimates the bill will add $850 billion to GDP annually, peaking at $906 billion in 2035.

In a rebuke to the Inflation Act and its “green corporate welfare,” the bill repeals over $500 billion in subsidies for electric vehicles, solar panels, and luxury home developers. It also eliminates tax breaks for sports team owners, targets left-wing nonprofits abusing tax-exempt status, and imposes the corporate tax rate on wealthy university endowments.

The bill slams the door on foreign abuse of U.S. tax law by ending tax benefits for illegal immigrants, closing Medicare loopholes, and fighting fraudulent claims under Obamacare.