Politics

Karoline Leavitt Gives Wall Street A Four-Word Warning

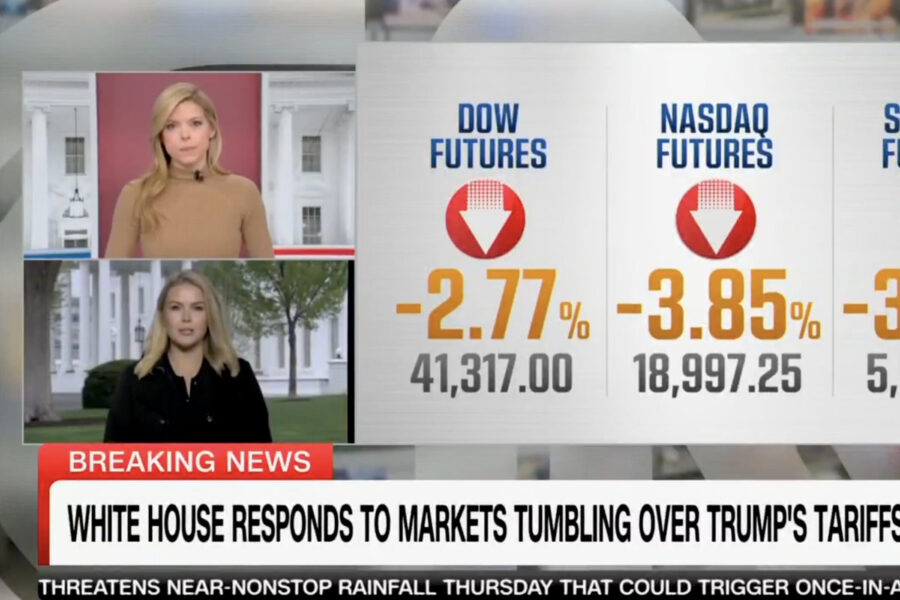

Trump administration officials fanned out on the airwaves one day after the president’s long-promised tariffs sent shockwaves around the globe, rattling markets as investors spooked by uncertainty about the global order sent indices into a nosedive.

U.S. stock markets cratered on Thursday, shedding an estimated $2.4 trillion in value in the greatest one-day decline since the onset of the Covid-19 pandemic. In response, White House Press Secretary Karoline Leavitt gave four words of wisdom to Wall Street.

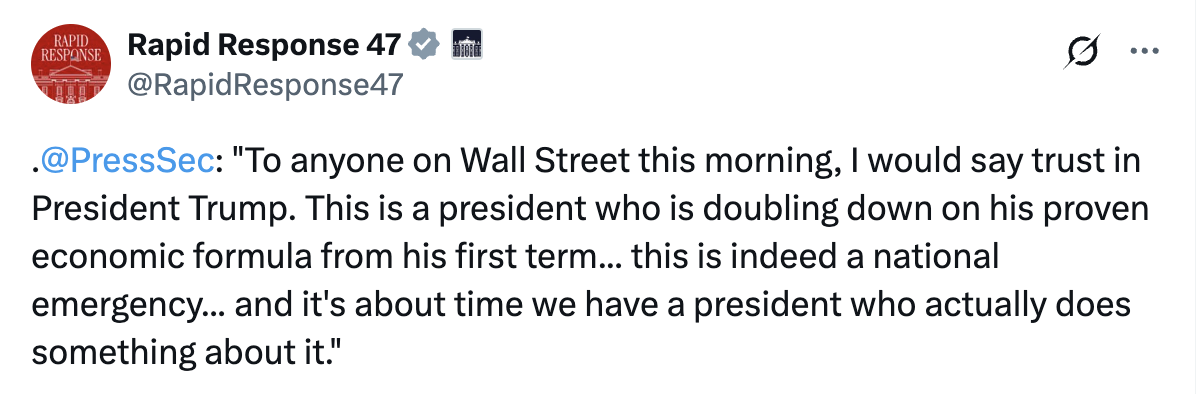

“Trust in President Trump,” she said on CNN Wednesday evening.

She continued: “This is a president who is doubling down on his proven economic formula from his first term… this is indeed a national emergency… and it’s about time we have a president who actually does something about it.”

A survey of economists by JPMorgan has raised the chance of a recession in 2025 to 60%, a sharp uptick following President Donald Trump’s blanket leveeing of tariffs on goods from countries who already impose tariffs of their own on U.S. products. China, among the most hard hit, responded with an equivalent 34% tariff on American goods one day later, the Daily Mail reported.

WATCH:

In a Friday morning message to his Truth Social followers, President Trump encouraged them to take advantage of declining stock prices and “buy the dip,” saying the time to buy has never been better.

“To the many investors coming into the United States and investing massive amounts of money, my policies will never change,” he wrote. “This is a great time to get rich, richer than ever before!!!”

Secretary of State Marco Rubio, who is in Brussels for a NATO conference, expressed confidence in the market’s ability to recover.

“Businesses around the world, including in trade and global trade, they just need to know what the rules are,” Rubio told members of the media on Friday. “Once they know what the rules are, they will adjust to those rules.”

“I don’t think it’s fair to say economies are crashing,” he added. “Markets are crashing because markets are based on the stock value of companies who today are embedded in modes of production that are bad for the United States.”

Conversely, U.S. treasury yields fell well below 4% as investors rushed to hoard cash in bonds and other relatively calm sectors.

Fed chairman Jerome Powell is slated to speak later Friday morning, and Wall Street will be looking for any hint about what the turbulence may do to future rate decisions, the Wall Street Journal reported.

SUGGESTED VIDEOS FOR YOU

Democrat Rep. LOSES HIS MIND during UNHINGED screaming match on Fox!

Sen. Kennedy SPILLS THE BEANS on Biden’s $2 billion GIFT to Stacey Abrams!

Ex-FBI agent ADMITS THE TRUTH about Biden laptop during Jordan grilling!

“CHECKMATE”; What EVERYONE missed from Trump’s tariff launch!

Amy Klobuchar MELTS DOWN during fiery debate with Ted Cruz!

Help Us ERADICATE The Left Wing Media By Subscribing To Our YouTube Channel!

Subscribe for Daily Reporting on the Trump Administration & Always Receive the Truth!