Politics

Malaysia and China Team up With ‘Asian Fund’ to Take on the U.S. Dollar

More bad news for the Biden administration.

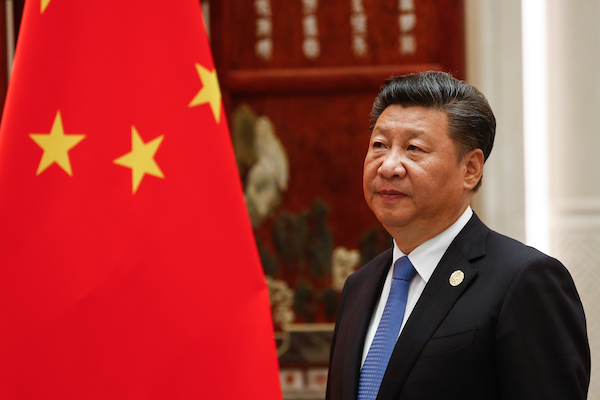

According to Malaysian Prime Minister Anwar Ibrahim, China is willing to engage in discussions about establishing an Asian Monetary Fund, resurrecting a proposal from decades ago that aimed to decrease dependence on the US dollar. Anwar put forth the idea of creating the fund, emphasizing the importance of reducing reliance on the International Monetary Fund or the US dollar.

Anwar said, “When I had a meeting with President Xi Jinping, he immediately said, ‘I refer to Anwar’s proposal on the Asian Monetary Fund’, and he welcomed discussions.”

“There is no reason for Malaysia to continue depending on the dollar.”

The proposal for an Asian Monetary Fund is not a new idea. It was first suggested in the late 1990s as a way to reduce Asia’s dependence on the International Monetary Fund and the US dollar following the Asian financial crisis.

The proposal failed to gain traction at the time due to opposition from the US and concerns about regional rivalries. However, with the rise of China as a major economic power and increasing trade tensions with the US, there has been renewed interest in the idea in recent years.

NEW: Malaysia Prime Minister says there is no reason to depend on the U.S. dollar as Malaysia & China team with the ‘Asian Fund’ to cut dependency on the dollar.

Are you paying attention yet?

— Collin Rugg (@CollinRugg) April 4, 2023

“But now with the strength of the economies in China, Japan and others, I think we should discuss this,” Anwar claimed. “At least consider an Asian Monetary Fund, and, secondly, the use of our respective currencies.”

An Asian Monetary Fund could potentially provide a regional safety net during times of financial instability and reduce Asia’s exposure to external economic pressures. Additionally, the use of local currencies for regional trade could potentially reduce dependence on the US dollar as the dominant global currency.

The Biden administration may have mixed feelings about the proposal for an Asian Monetary Fund as it could potentially weaken the US dollar’s status as the dominant global currency. The proposal could also be seen as a challenge to the role of the International Monetary Fund, which has traditionally played a central role in managing global financial stability.

Given the ongoing trade tensions and competition between the US and China, the proposal should also be viewed as another step towards reducing the US’s influence in the region. The Biden administration may also be concerned about potential implications for US economic interests and its ability to exert economic pressure on countries in the region.