Politics

NEW: Notorious Anti-Trump Senator Officially Hit With Criminal Referral

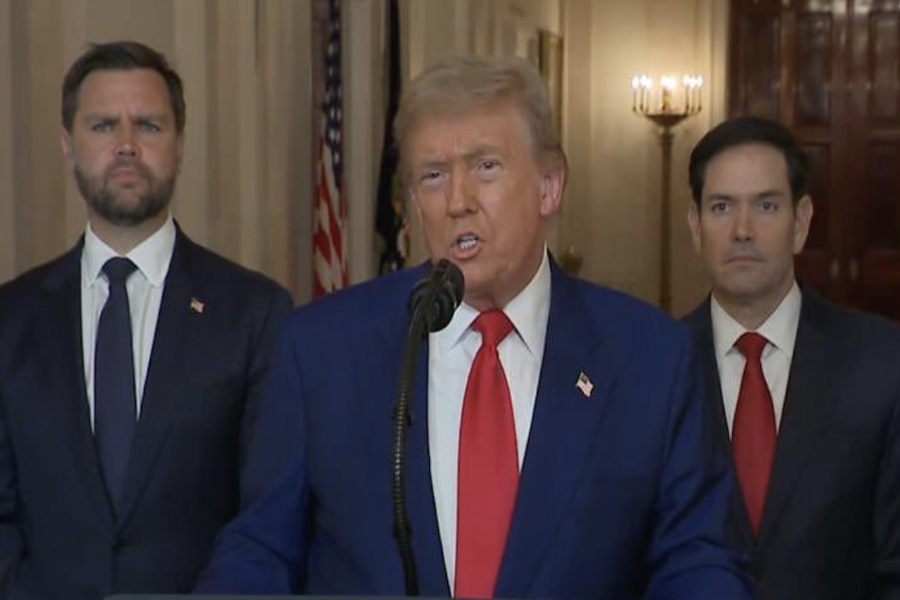

Federal housing authorities have officially handed over another Democratic official for criminal prosecution, the second time this year that the Trump administration has targeted a longtime foe of the president over allegations of mortgage fraud.

U.S. Sen. Adam Schiff (D-CA) is now under investigation for allegedly misrepresenting a property purchased in Maryland that he claimed was his primary residence while representing a congressional district in California. Schiff has been an avowed opponent of President Donald Trump since his first campaign.

U.S. Federal Housing Finance Agency Director William Pulte referred Schiff to U.S. Attorney General Pam Bondi in a letter alleging that the California Democrat listed the Maryland property as his primary residence between 2009 and 2020. He was the elected member of Congress for the 28th and 29th California congressional districts during that time.

“Based on media reports, Mr. Adam B. Schiff has, in multiple instances, falsified bank documents and property records to acquire more favorable loan terms, impacting payments from 2003-2019 for a Potomac, Maryland-based property,” FHFA Director Pulte wrote.

“As regulator of Fannie Mae, Freddie Mac, and the Federal Home Loan Banks, we take very seriously allegations of mortgage fraud or other criminal activity. Such misconduct jeopardizes the safety and soundness of FHFA’s regulated entities and the security and stability of the U.S. mortgage market.”

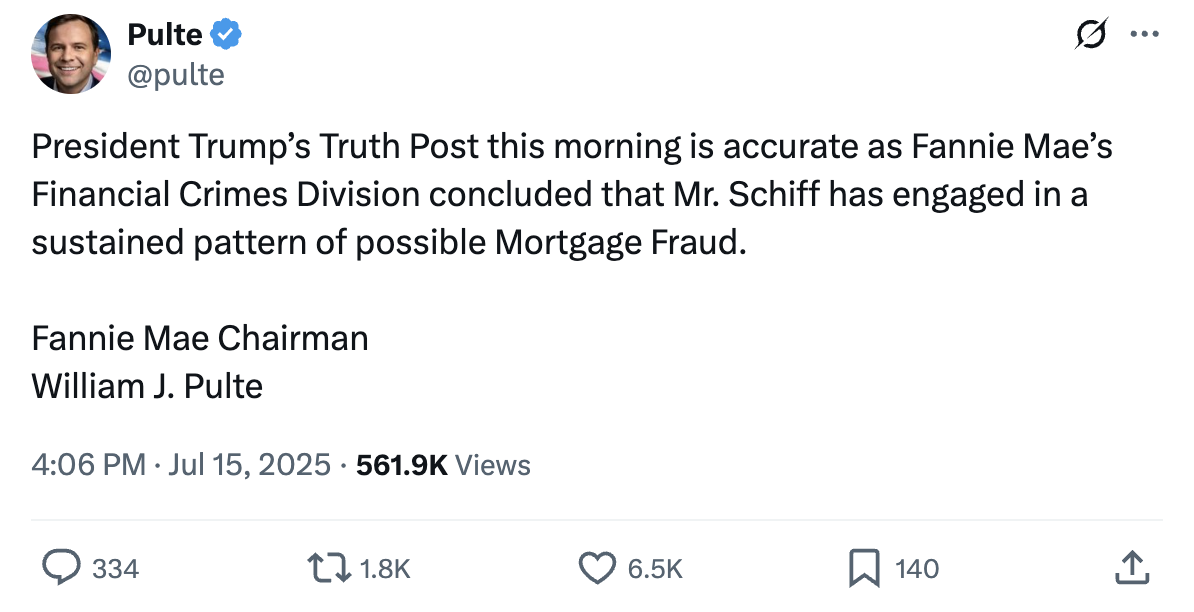

On Monday, Pulte stated that he received a report from the Fannie Mae Financial Crimes Division, which concluded that Schiff engaged in a “a sustained pattern of possible occupancy misrepresentation” on five government loans, Fox News reports.

It’s unclear if the U.S. Justice Department is yet involved in the investigation, but the development comes after President Trump first revealed the allegations against Schiff in a Truth Social post on Tuesday.

“And now I learn that Fannie Mae’s Financial Crimes Division have concluded that Adam Schiff has engaged in a sustained pattern of possible Mortgage Fraud,” Trump wrote. “Adam Schiff said that his primary residence was in MARYLAND to get a cheaper mortgage and rip off America, when he must LIVE in CALIFORNIA because he was a Congressman from CALIFORNIA.”

Pulte’s letter to Bondi references a Fannie Mae investigation, which allegedly indicates that Schiff listed his Maryland home as his primary residence on financial filings in 2009, 2011, 2012, and 2013.

While members of Congress are not constitutionally required to live in the district they represent, lawmakers are required to live in the state that contains their district. If Schiff indeed claimed his primary residence was in Maryland at the time, he would have run afoul of his electoral obligation to be a primary resident of California.

Over the same time frame, Schiff reported taking a homeowner’s tax exemption on a property in Burbank, Calif., writing off approximately $7,000, or 1% of his annual property tax, Pulte wrote, citing media reports.

“Primary residence mortgages receive more favorable loan terms, including lower interest rates, than secondary residence mortgages,” the letter said. “Lenders view secondary residence mortgages as significantly riskier, as a borrower is more likely to continue paying off a primary residence mortgage during any financial hardship. Interest rates on secondary residence mortgages are typically between 0.25-0.50% higher than their primary residence counterparts; however, this gap can widen depending on the lender.”

Such a violation may make Schiff eligible for prosecution under federal law, Pulte adds.

Schiff “appears to have falsified records in order to receive favorable loan terms, and also appears to have been aware of the financial benefits of a primary residence mortgage when compared to a secondary residence mortgage,” he wrote.

The letter includes a statement made in 2023 by a spokesman for Schiff who defended the arrangement.

“Adam’s California and Maryland addresses have been listed as primary residences for loan purposes because they are both occupied throughout the year and to distinguish them from a vacation property,” it read.

“There are unfortunately too many examples of individuals who commit fraud or mortgage fraud,” Pulte wrote. “As always, we look forward to cooperating with the Department of Justice to support any actions that the Department of Justice finds appropriate. U.S. Federal Housing FHFA appreciates the Department of Justice’s support in ensuring the protection of American homebuyers and taxpayers from mortgage fraud and other financial misconduct.”

The allegation is similar to one levied against New York Attorney General Letitia James, who was referred for criminal prosecution earlier this year after federal authorities discovered inconsistencies in her mortgage documents dating back decades. James has lawyered up, accusing Trump of pursuing a “political witch hunt” while benefitting from a secret $10 million public fund she can tap for legal expenses.