Politics

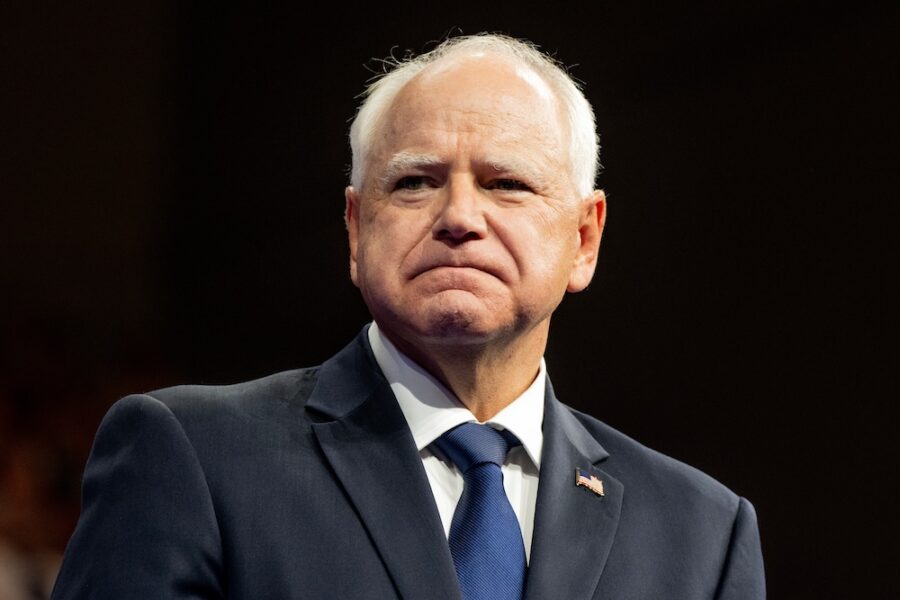

Tim Walz Ranked Dead Last In Survey, Gets ‘F’ Rating

A brand new analysis of fiscal policy ranking every governor in the country has been revealed, and the results are significant. Iowa Gov. Kim Reynolds came in first place while Democratic Minnesota Gov. Tim Walz, Kamala Harris’ vice presidential candidate and running mate, finished dead last. The report was released by the Cato Institute, which leans heavily libertarian and graded the states by their spending levels, revenue, and taxes.

Here’s a quick rundown of the top 10 states from Just The News: Iowa, Nebraska, West Virginia, Arkansas, South Dakota, Montana, Hawaii, Georgia, Idaho, and Vermont.

On the opposite end, the ten worst states are as follows: New Mexico, Missouri, Oregon, Michigan, Wisconsin, Delaware, Washington, Maine, New York, and lastly, Minnesota.

The six states listed at the bottom got an “F” on Cato’s report card. The poor rating for Walz hits just a couple of weeks out from the general election. The presidential race is proving to be a close one; early voting numbers, especially from Florida, where Republicans have a small lead, show a razor-thin contest brewing.

“The report explains the reasoning for Walz’ low score, pointing to a series of tax hikes under his leadership as well as spending increasing by 36% since 2022, from about $52 billion to nearly $71 billion,” Just The News reports.

Back in 2019, the Minnesota governor’s budget would have added $2 billion more new spending and taxation that would ultimately lead to an increase of $1.3 billion in order to pay for it, along with the rest of the cash coming from a surplus. But that’s not what happened. Walz made a compromise with the legislature, making the final tax increase $330 million yearly. He also made a hard push for increased taxation on gas and higher vehicle fees, all to raise a billion dollars for transportation a year.

“Walz pushed for more tax hikes in 2021. He proposed adding a new individual income tax rate of 10.85 percent above the current top rate of 9.85 percent, a surtax on capital gains and dividends, and a hike to the corporate tax rate from 9.8 percent to 11.25 percent. The proposals—which would have raised about $1.6 billion annually—were rejected by the legislature,” the report added.

Walz then slammed the middle class with HF 2887, a piece of legislation that raised taxes on registration for vehicles, deliveries, and sales for those who lived in the Twin Cities area.

On the opposite side, Republican Iowa Gov. Kim Reynolds managed to slash away at the top income tax rate, taking it from 8.98 percent to 8.53 percent, along with making reductions to the corporate tax rate, changing it to 9.8 percent, down from 12 percent.