Politics

Trump Sends Ominous Threat To Fed Chair: ‘Can’t Come Fast Enough’

One day after Federal Reserve Jerome Powell again refused to lower interest rates in response to an unsteady economic outlook, President Donald Trump issued his most direct threat yet on the embattled chairman’s future.

Powell, who has for years been a thorn in the side of Trump as he sought to nudge decisions on the future of America’s monetary policy, once more bucked the president’s call to forge ahead with lower rates, prompting Trump to sternly rebuke him and warn that he may soon be out of a job if things don’t change.

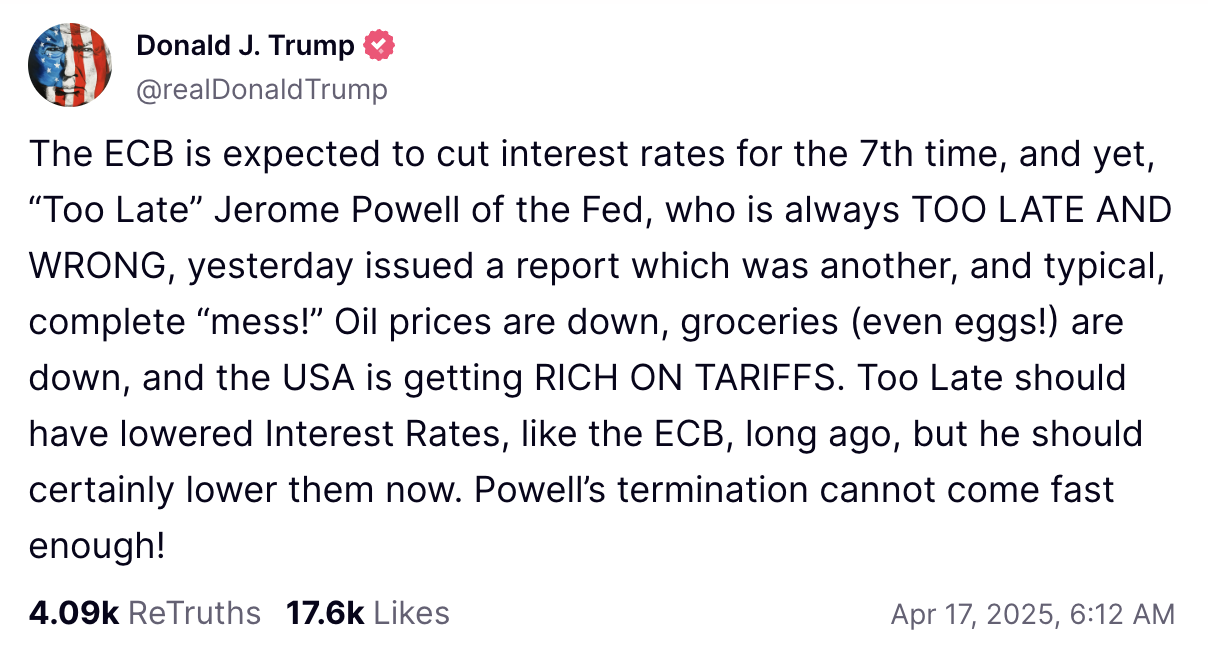

While the European Central Bank is expected to lower rates for the seventh time in recent months, “‘Too Late’ Jerome Powell… who is always TOO LATE AND WRONG, yesterday issued a report which was another, and typical, complete ‘mess!'” Trump wrote early Thursday morning.

The Fed chair has urged patience while the nation’s central bank weighs next steps. At a conference on Wednesday, Powell warned that the administration’s tariff policies have created a “challenging scenario” for economists to predict where the U.S. economy will head over the next quarter.

Part of Powell’s speech conveyed that the Fed has wide latitude to be patient with its interest rate decisions until it has more clarity about Trump’s economic policies, according to the New York Times. To Trump, the delay tactics signal something else: a fiddling Fed in need of a new leader.

“Oil prices are down, groceries (even eggs!) are down, and the USA is getting RICH ON TARIFFS. Too Late should have lowered Interest Rates, like the ECB, long ago, but he should certainly lower them now. Powell’s termination cannot come fast enough!” his Truth Social post concluded.

As a “matter of law,” the Fed operates independently of political influence, Powell explained Wednesday while reiterating that many in Washington feel the same way.

It is “very widely understood and supported in Washington and in Congress where it really matters,” he stated.

“People can say whatever they want. That’s fine. That’s not a problem, but we will do what we do strictly without consideration of political or any other extraneous factors,” he said on Wednesday.

The top concern among Wall Street titans is that President Trump will move to oust Powell before his term expires in May of 2026. He previously signed an executive order seeking to assert more control over the Fed’s policies, though the selection of interest rates was noticeably absent.

Those rates will continue to be set by the Fed’s Board of Governors, which is made up of seven presidentially appointed members of the central bank and a rotating set of five presidents from the regional reserve banks.

Despite the uncertainty around tariffs, the White House has healthy economic indicators to make its point that its policies are working. The U.S. Labor Department shattered expectations with its March jobs report showing employers added 228,000 positions, far more than the 140,000 economists expected and a sign that the optimistic outlook for business expansion is growing. Unemployment was largely steady at 4.2%, up from 4.1% in February.