Politics

Trump’s Net Worth Surges By Another $1.8 Billion Due To Continued Success Of Trump Media

Former President Donald Trump’s net worth soared by another $1.8 billion on Tuesday as a result of the continued success of the Trump Media & Technology Group, which trades under the ticker “DJT.”

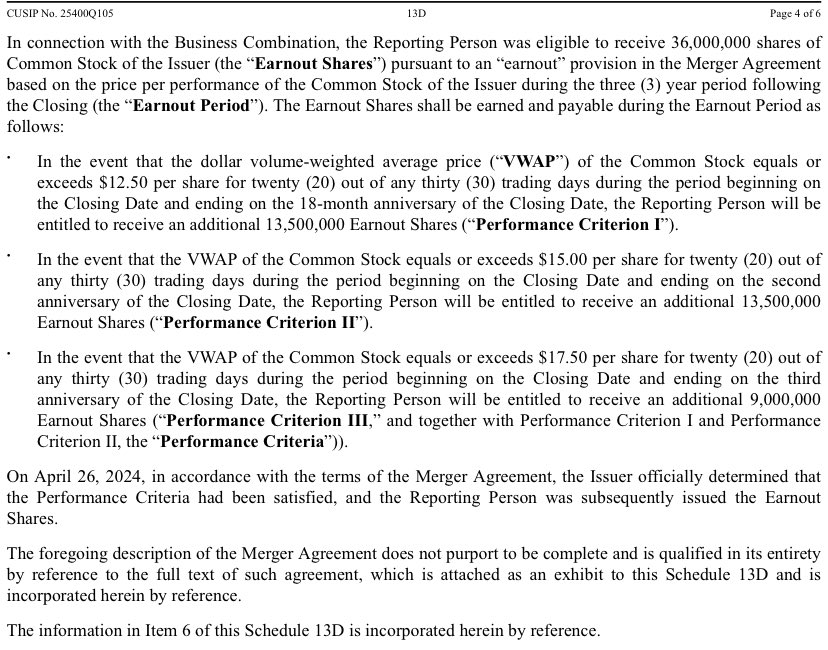

The Republican nominee for president received an “earnout” bonus from the company — whose main asset is Truth Social — as a reward for the stock staying above $17.50 a share for any 20 trading days within a 30-trading day period, according to a Tuesday regulatory filing. In total, Trump received an additional 36 million shares of the company’s stock.

With the bonus, Trump now owns 114.75 million shares of Trump Media. As of market close on Tuesday, DJT was trading at $49.83 per share, up 6.98 percent on a wildly successful day despite an overall brutal day on Wall Street that saw the DOW down 570 points. The company’s current worth would place Trump’s stake north of $5.7 billion.

Trump now owns roughly 65 percent of Trump Media and Technology Group.

After a brief rough stretch that saw losses over more than two weeks, the stock has surged by 43 percent since last Monday.

While Trump’s overall net worth continues to climb, he will not be able to cash out on his holdings in the immediate future. Trump’s shares are currently subjected to a lock-up period that restricts him and other Trump Media executives from selling their shares for another five months.

The surge comes after Trump media CEO Devin Nunes sent letters to Congress and the NASDAQ informing them of suspected “market manipulation” of the stock.

“Reports indicate that, as of April 3, 2024, DJT was ‘by far’ ‘the most expensive U.S. stock to short,’ meaning that brokers have a significant financial incentive to lend non-existent shares.2 Data made available to us indicate that just four market participants have been responsible for over 60% of the extraordinary volume of DJT shares traded,” Nunes wrote in a letter earlier this month.

“In light of the foregoing, and Nasdaq’s obligation and commitment to protect the interests of retail investors,3 please advise what steps you can take to foster transparency and compliance by ensuring market makers are adhering to Reg SHO, requiring brokers to disclose their ‘Net Short’ positions, and preventing the lending of shares that do not exist,” Nunes wrote. “TMTG looks forward to assisting your efforts.”