Politics

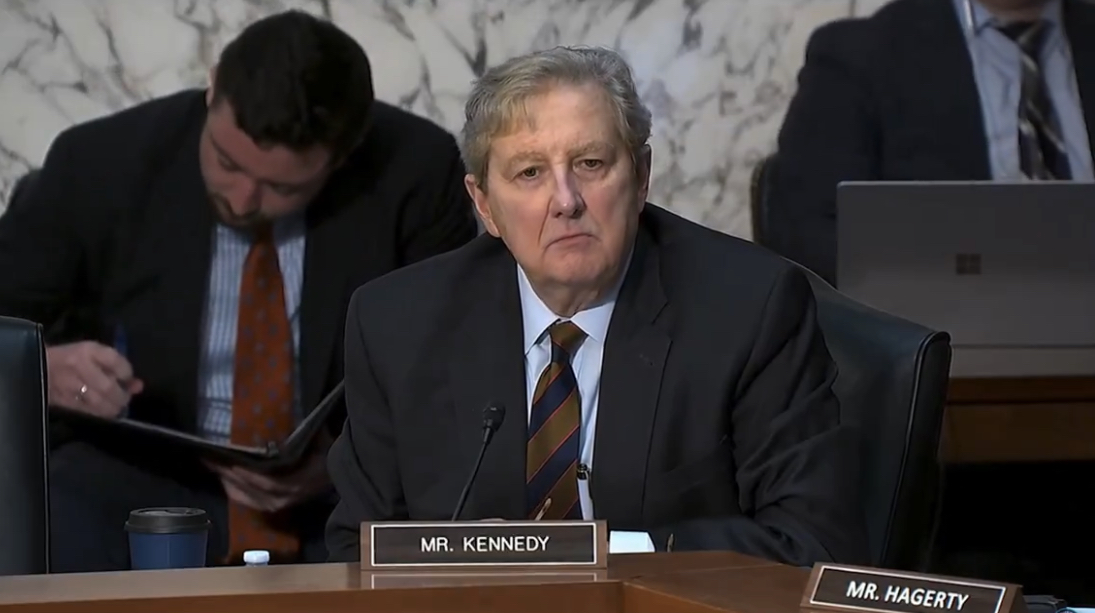

WATCH: John Kennedy Torches Banking CEOs With Priceless Jab

Senator John Kennedy (R-LA), long the source of some of the most hilarious moments in Congress, applied his trademarked incisive wit to the unsuspecting CEO of JP Morgan Chase Jamie Dimon during a Senate hearing on government regulation.

Senator Kennedy asked Dimon if JPMorgan Chase has ever had more liabilities on its books than assets, to which Dimon replied “Absolutely not.” The Senator then noted that three of the banks that collapsed in 2023 did. He rattled them off “Signature, Silicon Valley, First Republic.”

“In my judgment, they went broke because their management did really stupid stuff. And because the FDIC and the regulators who were in charge of keeping them from doing stupid stuff sat there, like bumps on a log, sucking on their teeth, and watched them do stupid stuff. And in many cases, had to turn to you to clean up the mess,” Kennedy explained.

“Now, in fairness to the FDIC, it may have been that the people in charge of watching those banks, at the FDIC, were too busy urinating off the top of a hotel, or abusing young women who went to work for the FDIC,” the longtime senator went on to say.

Kennedy then referred to a mounting scandal within the FDIC reported by the Wall Street Journal in November, in which “employees drank to excess at the Virginia hotel, including vomiting in the elevator, urinating off the roof.”

He continued, “The FDIC chairman told us recently, yes, he knew about it, it happened, but he wasn’t the chairman yet and didn’t have the authority to stop it.”

“Mr. Dimon, don’t you find it ironic, the FDIC is now turning to you and saying, ‘you know our track record, which is blemished at the FDIC, your bank isn’t broken but we’re going to tell you how to fix it.’ Do you find that ironic?” he continued. “They’re going to tell you how to fix it based on standards put together by bureaucrats in Basel, Switzerland, not by the United States Congress. Do you find it ironic that they’re telling you this and proposing this, isn’t that kind of like being given gun safety advice by Alec Baldwin?”

The joke definitely hit home, putting Dimon off balance momentarily as a chuckle spread around the room including the CEO and his fellow witnesses.

Dimon replied to Kennedy by claiming that the risks that the failed banks suffered were “hiding in plain sight,” adding that risks associated with “transparency” brought about by a new rule creation process could harm U.S. banks.