Politics

BUD LIGHT UPDATE: Anheuser-Busch Has Now Lost $27B Since Mulvaney Stunt

Anheuser-Busch InBev, the parent company of Bud Light, is facing a bitter financial hangover following a controversial partnership with Dylan Mulvaney. The company’s shares have seen a significant decline, wiping out a staggering $27 billion in market value since the ill-advised campaign was launched.

This partnership has left many conservatives feeling alienated and has sparked a nationwide boycott of Bud Light and other Anheuser-Busch products. The swift and severe response from the market has demonstrated the tangible costs of prioritizing virtue signaling over consumer sentiment and business fundamentals.

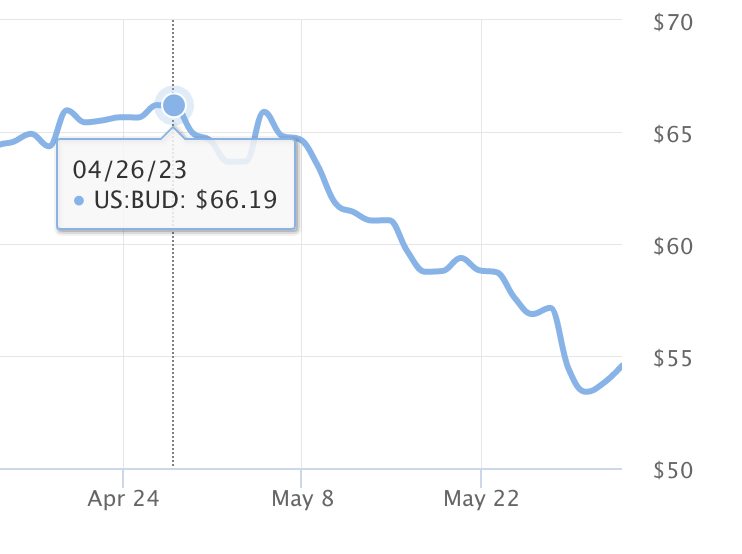

Anheuser-Busch InBev’s market capitalization has faced a significant loss over the past two months. The shares of Bud Light’s parent company have seen a decline of more than 20% since the company initiated its controversial marketing partnership with Mulvaney.

Anheuser-Busch InBev’s market capitalization has faced a significant loss over the past two months. The shares of Bud Light’s parent company have seen a decline of more than 20% since the company initiated its controversial marketing partnership with Mulvaney.

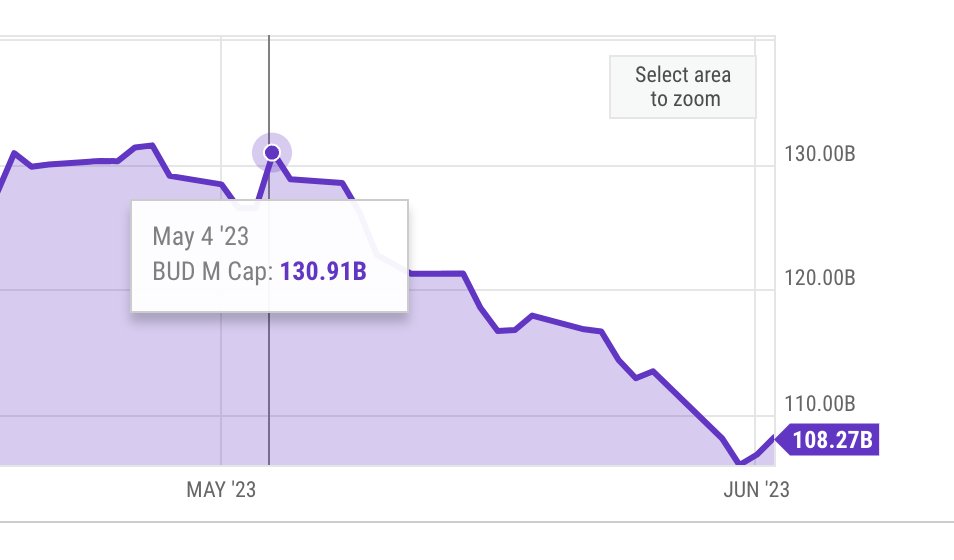

On May 4, Anheuser-Busch’s market cap sat around $130B. As of today, it is a mere $108B.

JUST IN: Modelo is on pace to surpass Bud Light as the world's number 1 beer brand after Bud Light saw a 25.7% decrease in sales last week.

While Bud Light is down, Modelo saw an increase in sales by 9.2% for the week ending on May 20.

According to Bump Williams Consulting and… pic.twitter.com/LeS3LkliAF

— Collin Rugg (@CollinRugg) May 30, 2023

As a result, the company’s stock has fallen to a new eight-month low of about $53, reflecting a stark contrast to broader market gains. This marked decline came into play on March 31, the day before Mulvaney shared a video on TikTok showcasing personalized cans of Bud Light sent to her by the company, commemorating the anniversary of coming out as transgender.

The company’s sales have followed a similar downward trajectory, slipping by 10% or more over each of the last four weeks compared to the same week last year, according to NielsenIQ data cited by Goldman Sachs. In terms of market capitalization, the loss for Anheuser-Busch has been substantial, totaling $27 billion over the last two months.