Politics

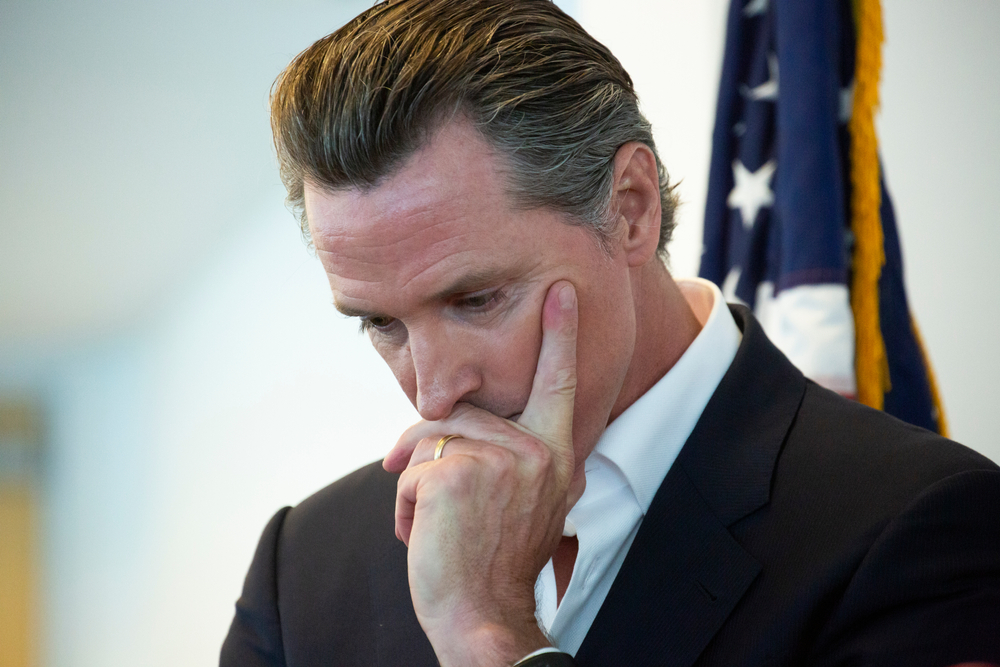

CA Governor Gavin Newsom Proposes Tax on People who Leave California

California Democrats are attempting to gain control of things that don’t belong to them by gouging former residents of their hard earned money.

Democrat assemblyman Alex Lee expressed the belief on social media that the wealthy have a responsibility to pay more in taxes, even if their wealth is in the form of unrealized investments.

Last week a bill was introduced in the California State Legislature that would impose an extra annual 1.5% tax on those with a “worldwide net worth” above $1 billion. The bill would take effect as early as January 2024.

The most bizarre part? This tax would even apply to people who have already left California.

Yahoo! explains below:

Exit taxes aren’t new in California. But this bill also includes provisions to create contractual claims tied to the assets of a wealthy taxpayer who doesn’t have the cash to pay their annual wealth tax bill because most of their assets aren’t easily turned into cash. This claim would require the taxpayer to make annual filings with California’s Franchise Tax Board and eventually pay the wealth taxes owed, even if they’ve moved to another state.

Lee tweeted “The working class has shouldered the tax burden for too long. “The ultra-rich are paying little to nothing by hoarding their wealth through assets. Time to end that.”

The state of California is known for taking money and assets from others, driven by the need to fund various free programs and potential reparations. To take away from the success of others is unacceptable.

The latest plan for confiscation is the introduction of a proposed “wealth tax” targeting the wealthy. The bill, which is expected to be introduced by California assemblymen, will aim to collect a portion of “worldwide net worth” from both current and past residents.

Fox News Digital pointed out that the administrative costs alone would require an additional tax burden of more than $40,000 for each individual who would be affected by the new tax.

“The proposed California wealth tax would be economically destructive, challenging to administer and would drive many wealthy residents — and all their current tax payments — out of state. The bill sets aside as much as $660 million per year just for administrative costs, more than $40,000 per prospective taxpayer, giving an idea of how difficult such a tax would be to administer.”

The bill aims to penalize individuals who do not wish to participate in large-scale government redistribution. The legality of the bill is uncertain, but it also proposes to confiscate assets from those who relocate to states with more freedom and fewer strict regulations.