Politics

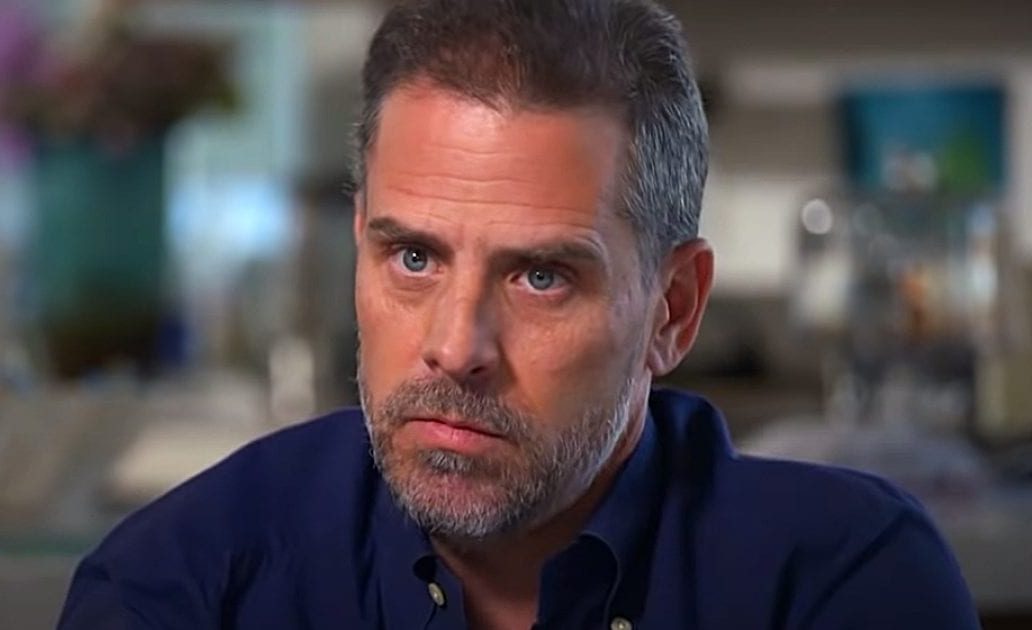

Hunter Biden’s Go-To Excuse SHATTERED By Latest Charges

The latest indictment against Hunter Biden by special counsel David Weiss strikes at the heart of a defense the embattled first son has used in court over the years, namely that his legal transgressions were the product of his struggles with addiction. New filings by Weiss indicate that prosecutors argue Hunter continued to flout the law even after gaining sobriety.

In a 56-page filing with the U.S. Central District Court of California, Weiss and his team detail allegations that Hunter only filed some missing tax returns years after gaining sobriety and never directed payments to reduce his tax obligation from those years.

“Notably, in 2020, well after he had regained his sobriety, and when he finally filed his outstanding 2016, 2017, and 2018 Forms 1040, the Defendant did not direct any payments toward his tax liabilities for each of those years,” the indictment reads on page 16 and highlighted by The Daily Caller.

“At the same time, the Defendant spent large sums to maintain his lifestyle from January through October 15, 2020. In that period, he received financial support from Personal Friend totaling approximately $1.2 million. The financial support included hundreds of thousands of dollars in payments for, among other things, housing, media relations, accountants, lawyers, and his Porsche,” the indictment adds.

From 2016 to 2018, Hunter spent approximately $70,000 on sobriety programs to gain control over addictions to alcohol and crack cocaine. During those years and continuing into 2019, prosecutors claim, he spent $4.9 million on drugs, prostitutes, and luxury goods instead of paying down his outstanding tax bills. A failed plea deal earlier this summer claims Hunter began sober in May of 2019.

“The Defendant engaged in a four-year scheme to not pay at least $1.4 million in self-assessed federal taxes he owed for tax years 2016 through 2019, from in or about January 2017 through in or about October 15, 2020, and to evade the assessment of taxes for tax year 2018 when he filed false returns in or about February 2020,” the indictment says.

“Between 2016 and October 15, 2020, the Defendant individually received more than $7 million in total gross income. This included an excess of $1.5 million in 2016, $2.3 million in 2017, $2.1 million in 2018, $1 million in 2019 and approximately $188,000 from January through October 15, 2020. In addition, from January through October 15, 2020, the Defendant received approximately $1.2 million in financial support to fund his extravagant lifestyle.”

Since being appointed special prosecutor, Weiss, whose home base is the district of Delaware, has expanded his probe of Hunter into California where the latest series of charges include three counts each of evasion of a tax assessment, failure to file and pay taxes, and filing a false or fraudulent tax return. The U.S. Attorney for the central California district, who has a history of donating to Vice President Kamala Harris, previously refused to bring charges against the president’s son.

Similarly, the Justice Department was planning to dismiss all charges against Hunter until whistleblowers with the IRS came forward claiming political pressure from above was stymying their investigation, including stonewalling efforts that could have implicated President Joe Biden.

In recent weeks, Hunter and his legal team have gone on the offensive, offering to testify before House Republicans on the condition that the hearing be open to the public. He has written an op-ed accusing various Republicans of leveraging his legal troubles for unfair gain and has demanded a “meritless” subpoena for former President Donald Trump. The legal saga is “consuming” President Biden, who frequently lashes out at aides suggesting he distance himself from his troubled son.